Table of Contents

- 1 What is the dividend payout ratio?

- 1.1 Why Is the Dividend Payout Ratio Important?

- 1.2 How Do You Calculate the Dividend Payout Ratio?

- 1.3 Calculating the Dividend Payout Ratio in Excel

- 1.4 Example of the Dividend Payout Ratio

- 1.5 What does a dividend payout ratio indicate?

- 1.6 What does it mean if dividend payout ratio is less than 100%?

- 1.7 Dividend Payout Ratio vs. Dividend Yield

- 1.8 Why Do Companies Pay Dividends Instead of Reinvesting to the Company?

- 1.9 FAQ

What is the dividend payout ratio?

The dividend payout ratio measures the proportion of a company’s net income that is distributed to its shareholders through dividends.

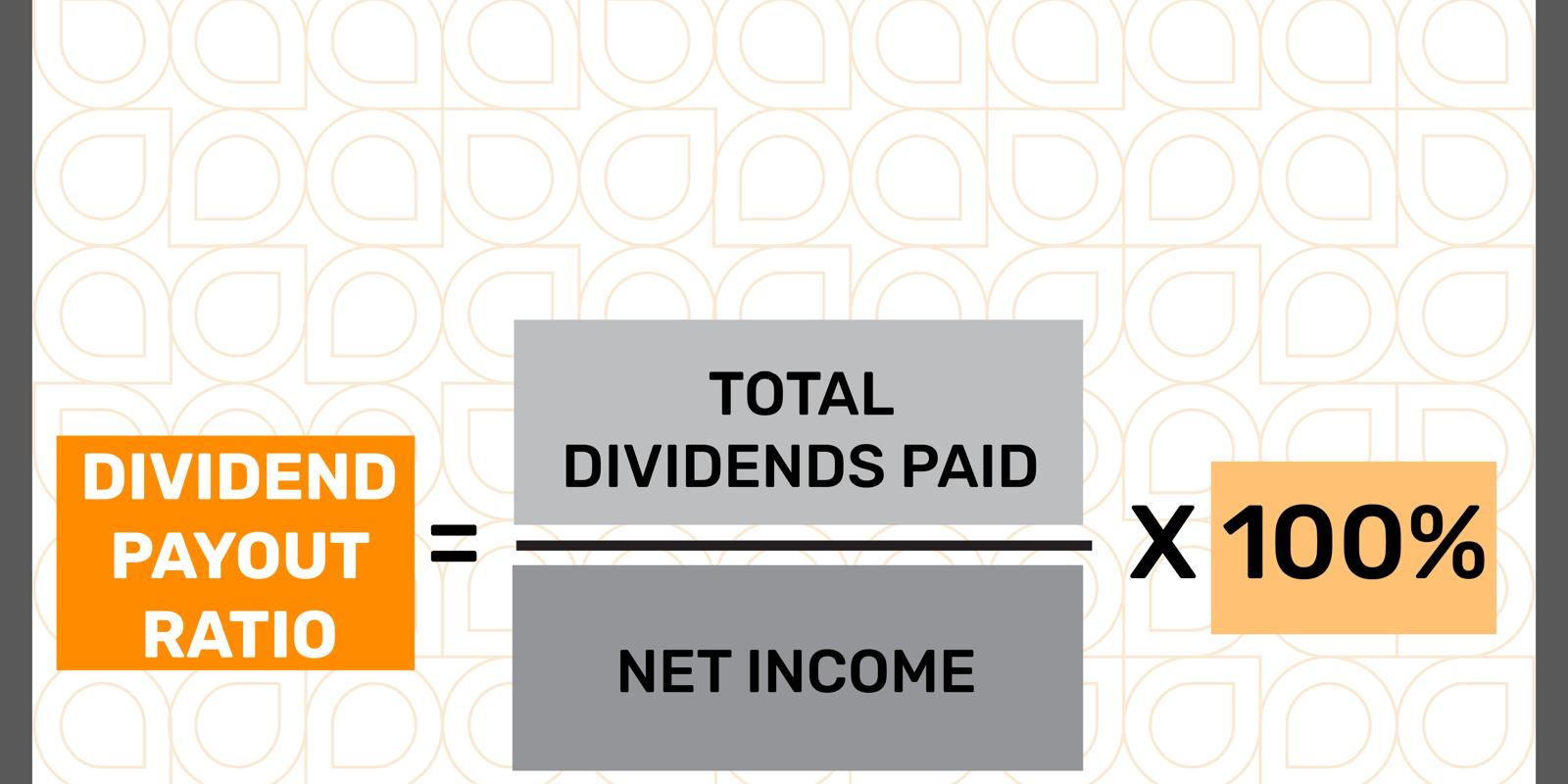

Formula for “Dividend Payout Ratio” = (Total Dividends Paid / Net Income) × 100%

Dividend payout ratio can also be calculated as follows:

Dividend Payout Ratio = (Dividend Per Share (DPS)/ Earnings Per Share (EPS)) × 100

Why Is the Dividend Payout Ratio Important?

The dividend payout ratio is important because it might give an idea about a company’s financial health and stability, because, a balanced dividend payout ratio shows a company’s ability to reward shareholders while also giving importance for growth. When investors see too high dividend payout ratio, they may see it as a signal of risk, and when it is too low, it shows a lack of shareholder returns.

How Do You Calculate the Dividend Payout Ratio?

The dividend payout ratio is calculated by dividing the total dividends paid in a year by a company’s annual net income. In other words, it shows in percentage terms how much of a company’s earnings are distributed to shareholders as dividends.

Calculating the Dividend Payout Ratio in Excel

If you are using Excel to calculate the dividend payout ratio, here is the basic steps that you can follow:

- Enter “Total Dividends Paid” in cell B1

- Enter “Annual Net Income” in cell C1

- Dividend Payout Formula = B1/C1

- To display the result as a percentage, select the cell with the formula, go to the Home tab and click on the percent style (%) button.

Example of the Dividend Payout Ratio

Calculation of dividend payout ratio for Company A

| Dividend Payout Ratio Calculation for FY23 | |

| Net Income (IQD) | 10,000,000,000 |

| Total Dividends Paid (IQD) | 4,000,000,000 |

| Number of Outstanding Shares (IQD) | 2,000,000,000 |

| Earnings Per Share (EPS) (IQD) | 5.000 |

| Dividends Per Share (DPS) (IQD) | 2.000 |

| Dividend Payout Ratio = (Total Dividends Paid / Net Income) x 100 | 40% |

| Dividend Payout Ratio = (DPS / EPS) x 100 | 40% |

The dividend payout ratio for Company A is 40%. This means that the company distributes 40% of its profit as dividends to shareholders while retaining the remaining 60% for reinvestment or other purposes. As a result, it indicates a balanced approach, rewarding shareholders while keeping some funds for growth.

When investing in companies listed on the Iraq Stock Exchange (ISX), investors who want to evaluate the dividend payout ratio will find that it is not readily available and must calculate this ratio themselves. The above example for Company A shows two different formulas for calculating the dividend payout ratio.

What does a dividend payout ratio indicate?

The dividend payout ratio shows the percentage of profits a company distributes to its shareholders.

A higher dividend payout ratio (above 50-60%) indicates that the company prioritizes rewarding shareholders with dividends, while a lower ratio suggests that the company retains more of its earnings for reinvestment in expansion or to pay down debt.

A high payout ratio is typically seen in mature and stable companies, while a low payout ratio is more common for growth-oriented companies. It is worth noting that a dividend payout ratio exceeding 100% may not be sustainable in the long term. However, a balanced ratio indicates that the company is considering both shareholder returns and its financial strength. This ratio helps investors evaluate whether a company’s dividend policy aligns with its long-term growth prospects and their investment goals.

What does it mean if dividend payout ratio is less than 100%?

When companies decide to retain part of their profits for expansion while distributing a portion to shareholders, their dividend payout ratio will be less than 100%, meaning they don’t distribute all their profits as dividends. This can be viewed positively if the retained profits are used wisely by the company to fuel growth, which may lead to capital gains through an increase in share price.

Dividend Payout Ratio vs. Dividend Yield

Dividend payout ratio and dividend yield both provide insights into a company’s dividend distribution; however, they measure different aspects. While the dividend payout ratio shows the percentage of a company’s annual net income that is paid out to shareholders as dividends; dividend yield shows the percentage of a company’s stock price that is returned to investors as dividends annually.

Why Do Companies Pay Dividends Instead of Reinvesting to the Company?

Companies sometimes prefer to pay dividends instead of reinvesting all their profits due to several strategic and financial reasons. The main reasons behind dividend distribution decisions are attracting and retaining investors, signaling financial health, limited growth opportunities, returning excess cash, maintaining market reputation, and balancing capital structure. Companies prefer to reinvest dividends mainly when they expand their operations, funding new products and investments and acquiring other companies.

FAQ

-

Is a High Dividend Payout Ratio Good?

To decided whether a high dividend payout ratio is good, several factors needs to be evaluated such as the company’s financial health, industry, and investor goals.

-

What Is the Difference Between the Dividend Payout Ratio and Dividend Yield?

The dividend payout ratio shows the percentage of a company’s annual net income that is paid out to shareholders as dividends; while dividend yield shows the percentage of a company’s stock price that is returned to investors as dividends annually.