Table of Contents

- 1 What should I do first before buying stocks on the ISX?

- 2

- 3 How to Buy Stock For Beginners?

- 4 Which Stocks to Buy?

- 5 Where to Buy Stocks and How?

- 6 How Can I Benefit from the Research Reports of Rabee Securities while Picking Stocks to Buy?

- 7 Buying Stocks Online: How can I Buy Stocks through the RABEE App?

- 7.0.1 1. Welcome Screen

- 7.0.2 2. Sign Up Screen

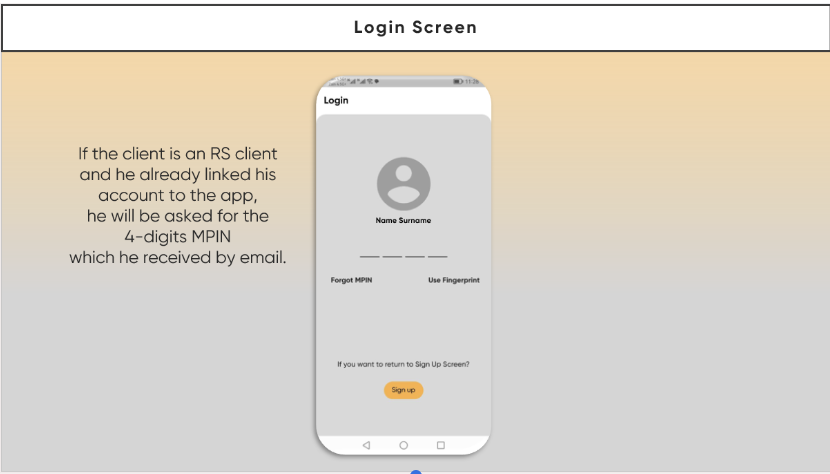

- 7.0.3 3. Login Screen

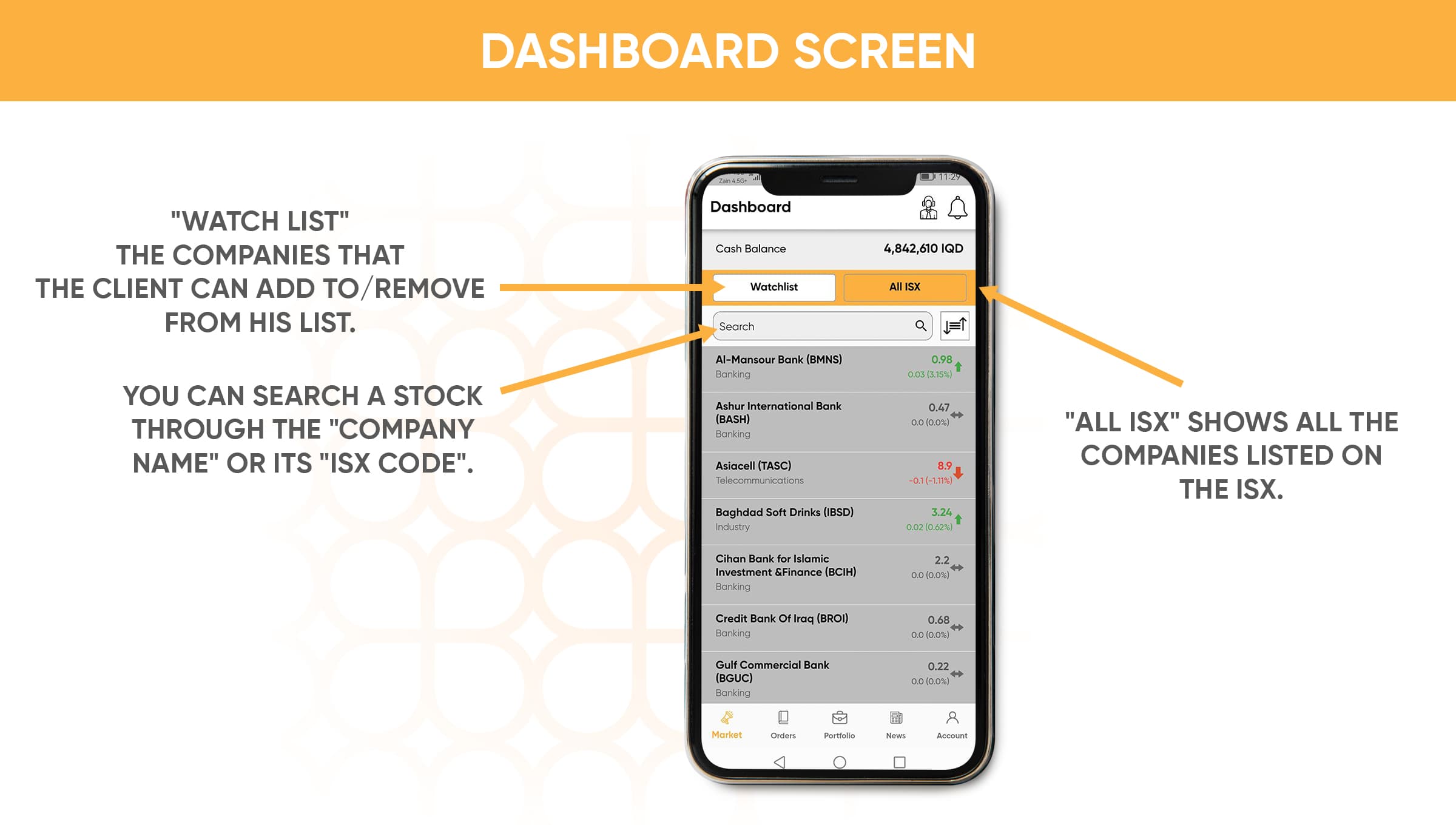

- 7.0.4 4. Dashboard Screen |

- 7.0.5

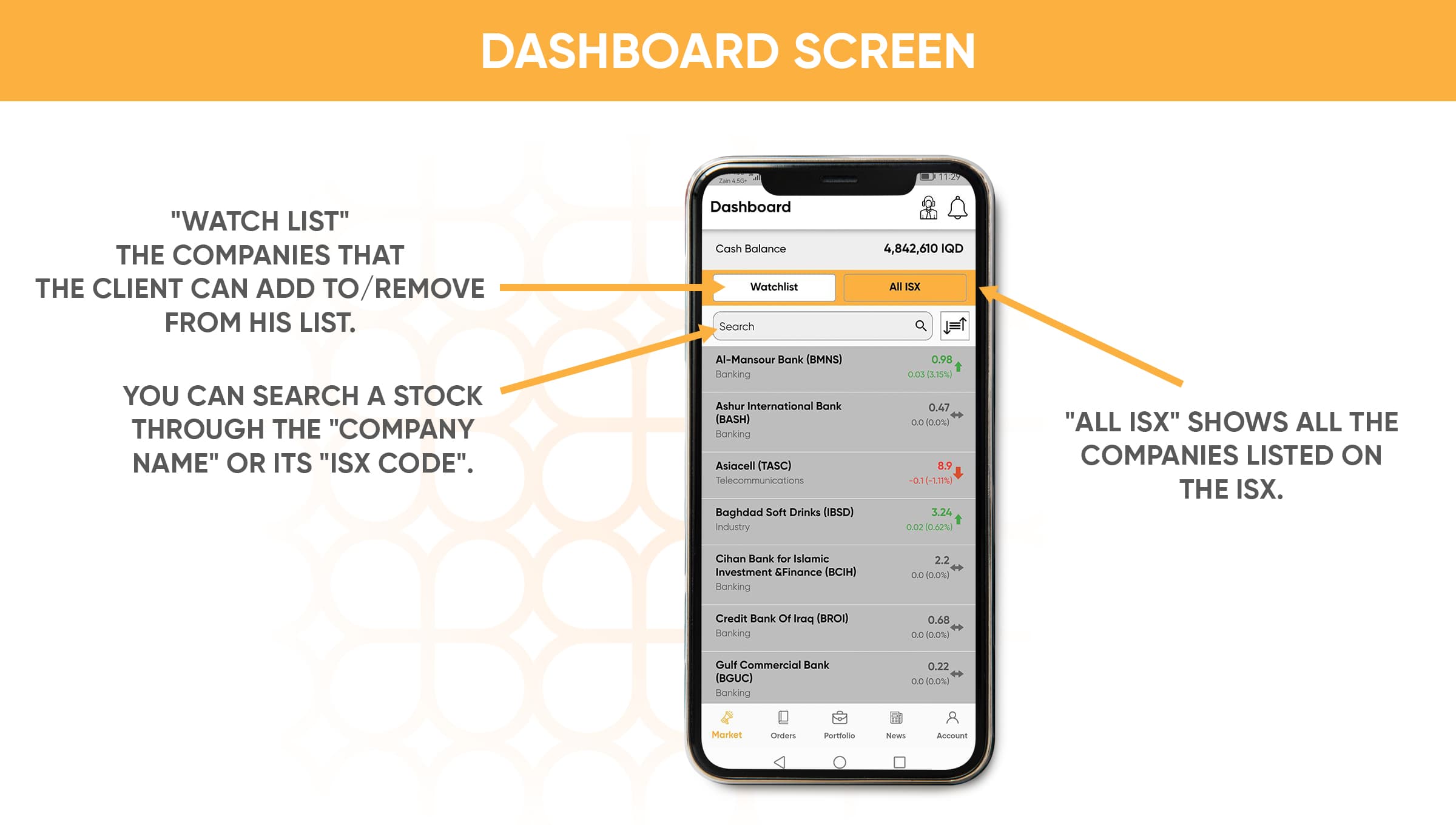

- 7.0.6 5. Dashboard Screen ||

- 7.0.7

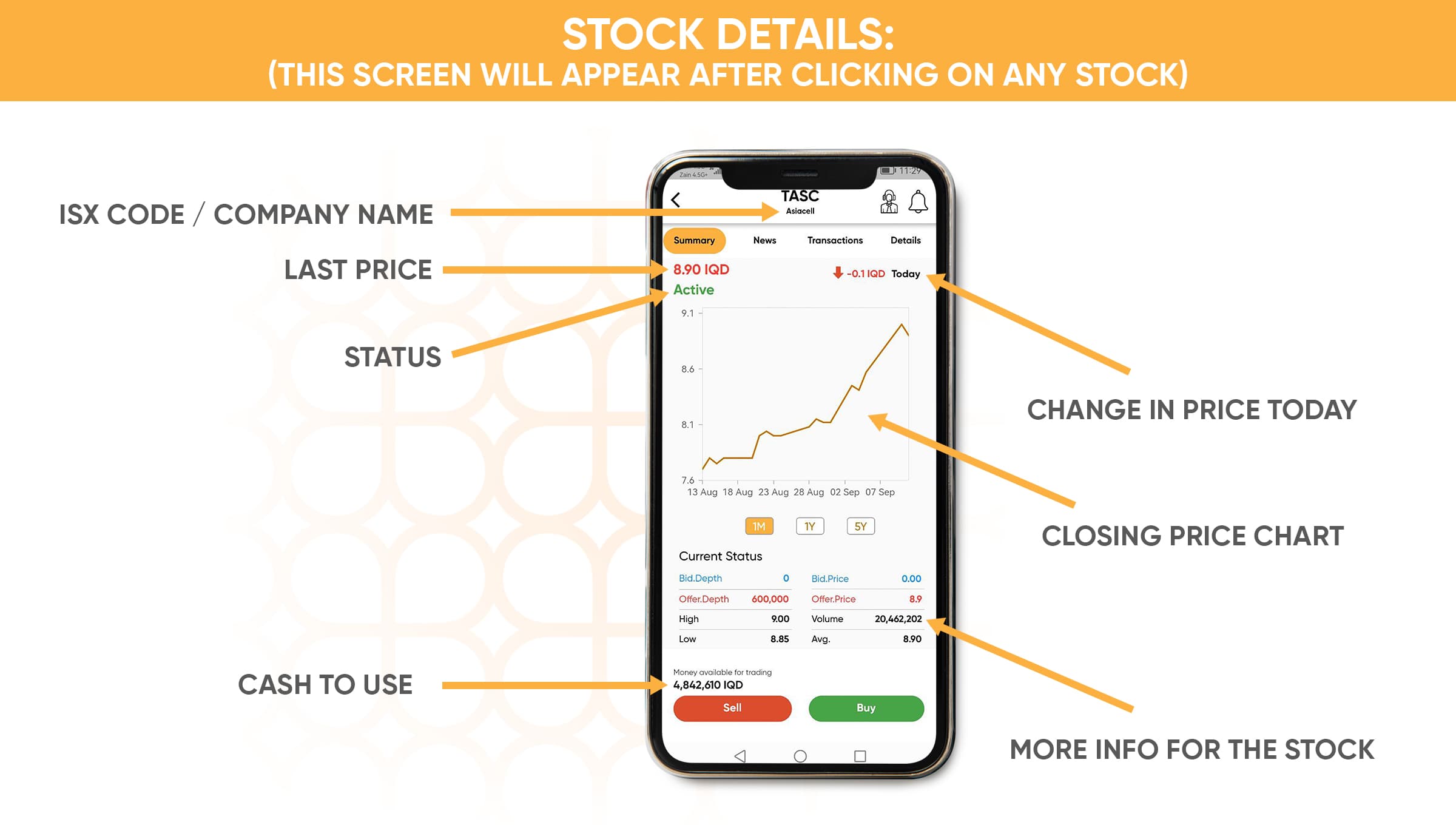

- 7.0.8 6. Stock Details

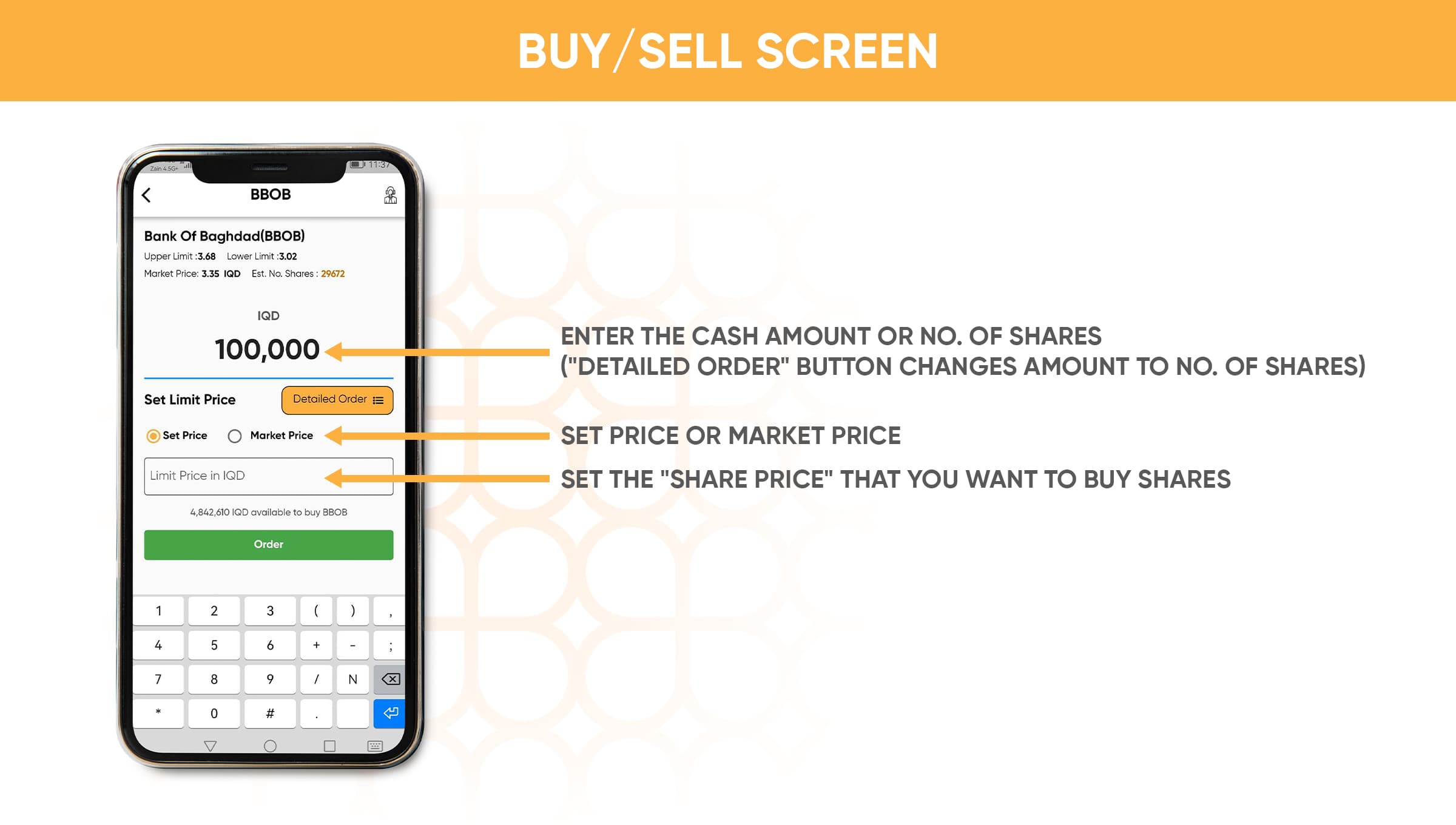

- 7.0.9 7. Buy / Sell Screen

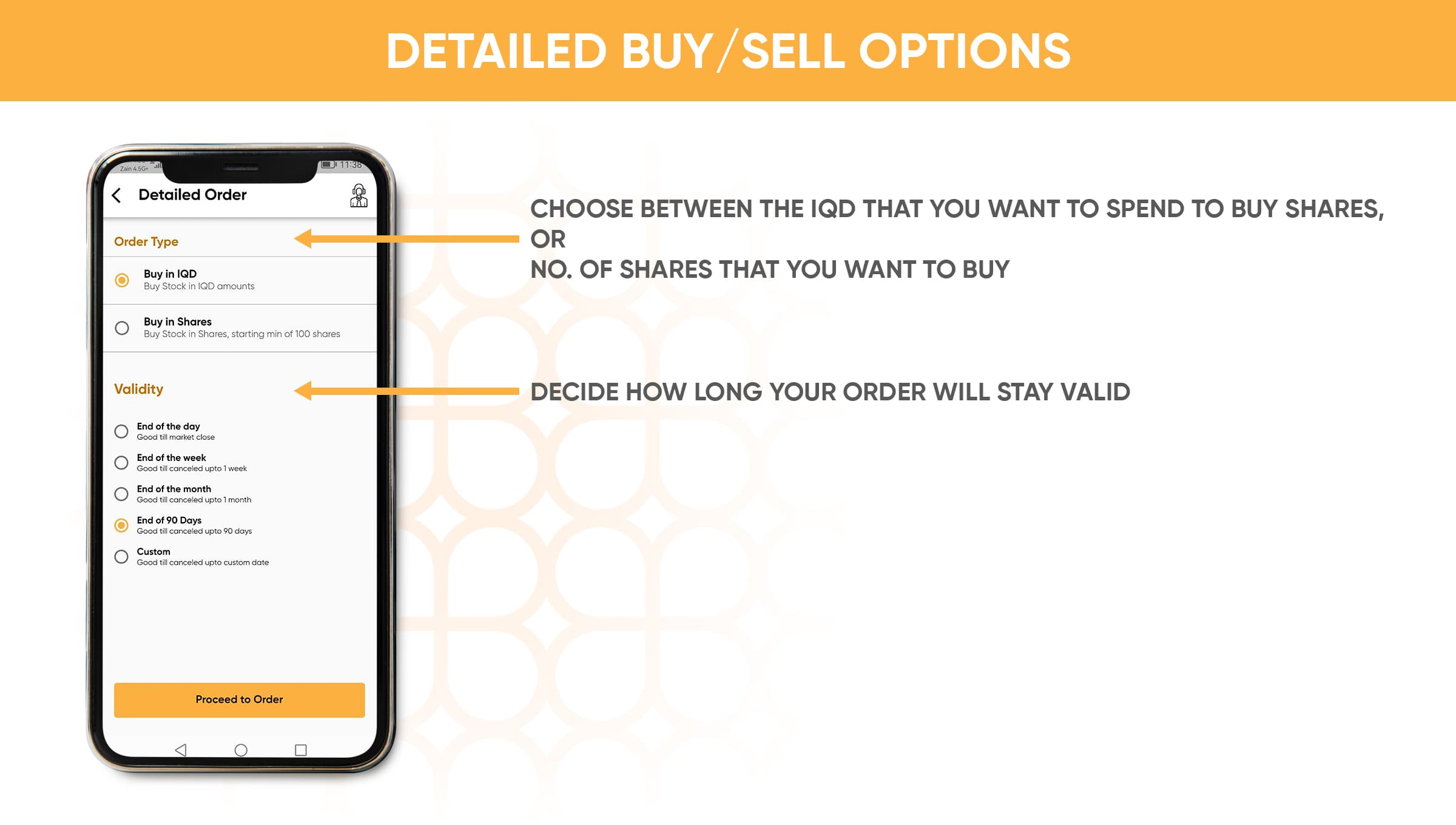

- 7.0.10 8. Detailed Buy/Sell Screen

- 7.0.11 9. Buy / Sell Screen Confirmation

- 7.0.12

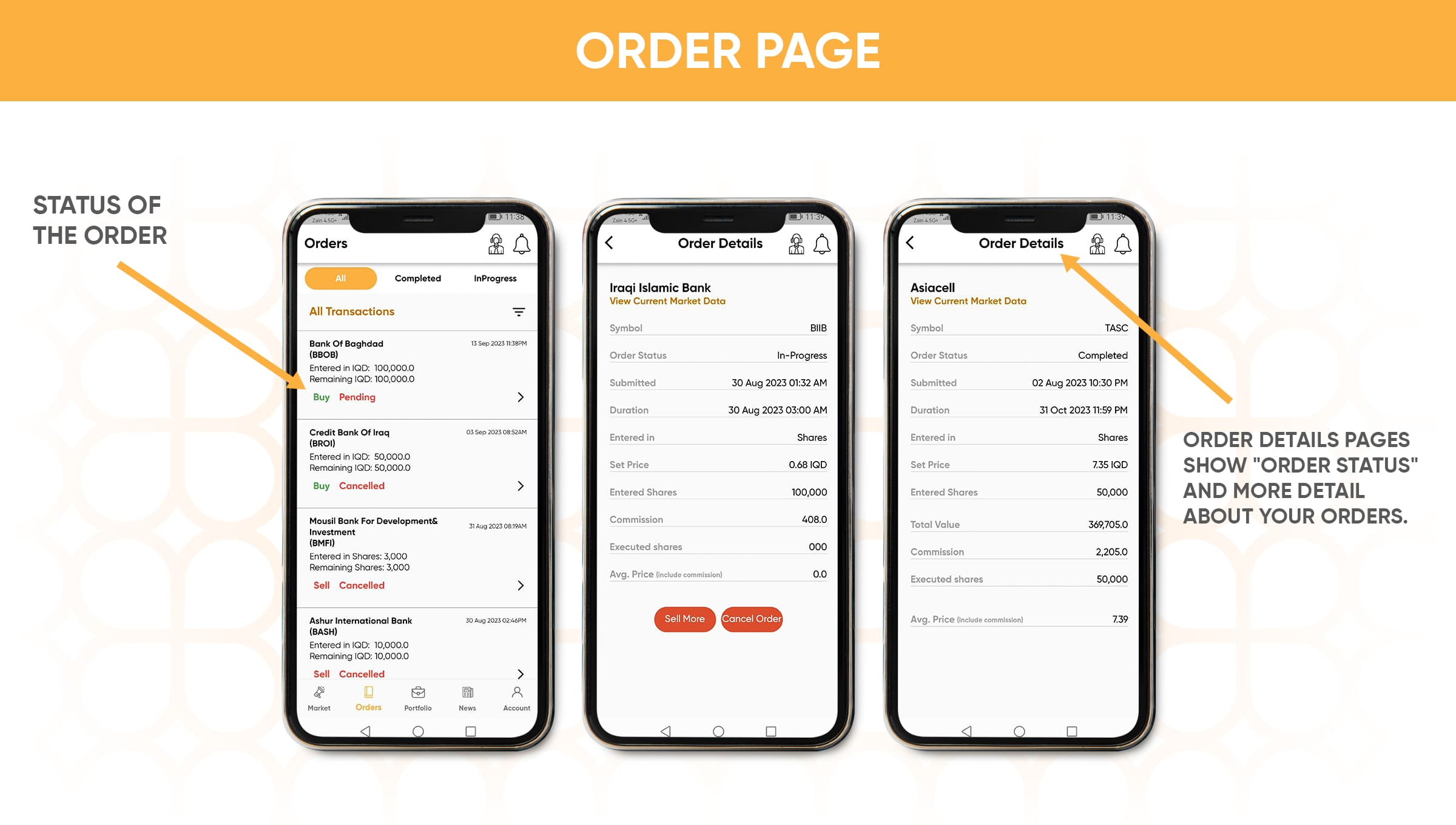

- 7.0.13 10. Order Page

- 7.0.14 11. Portfolio Page

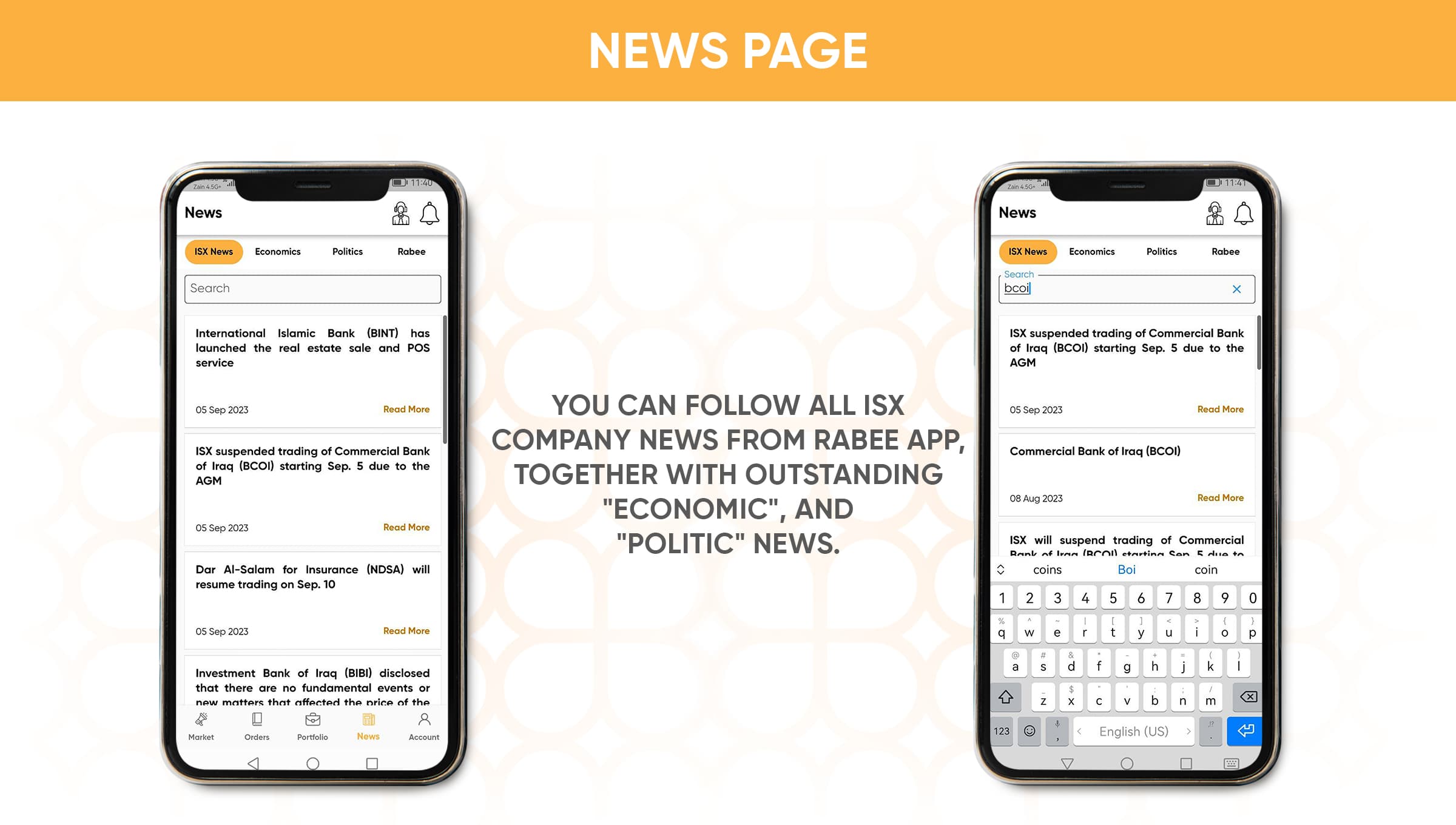

- 7.0.15 12. News Page

- 7.0.16

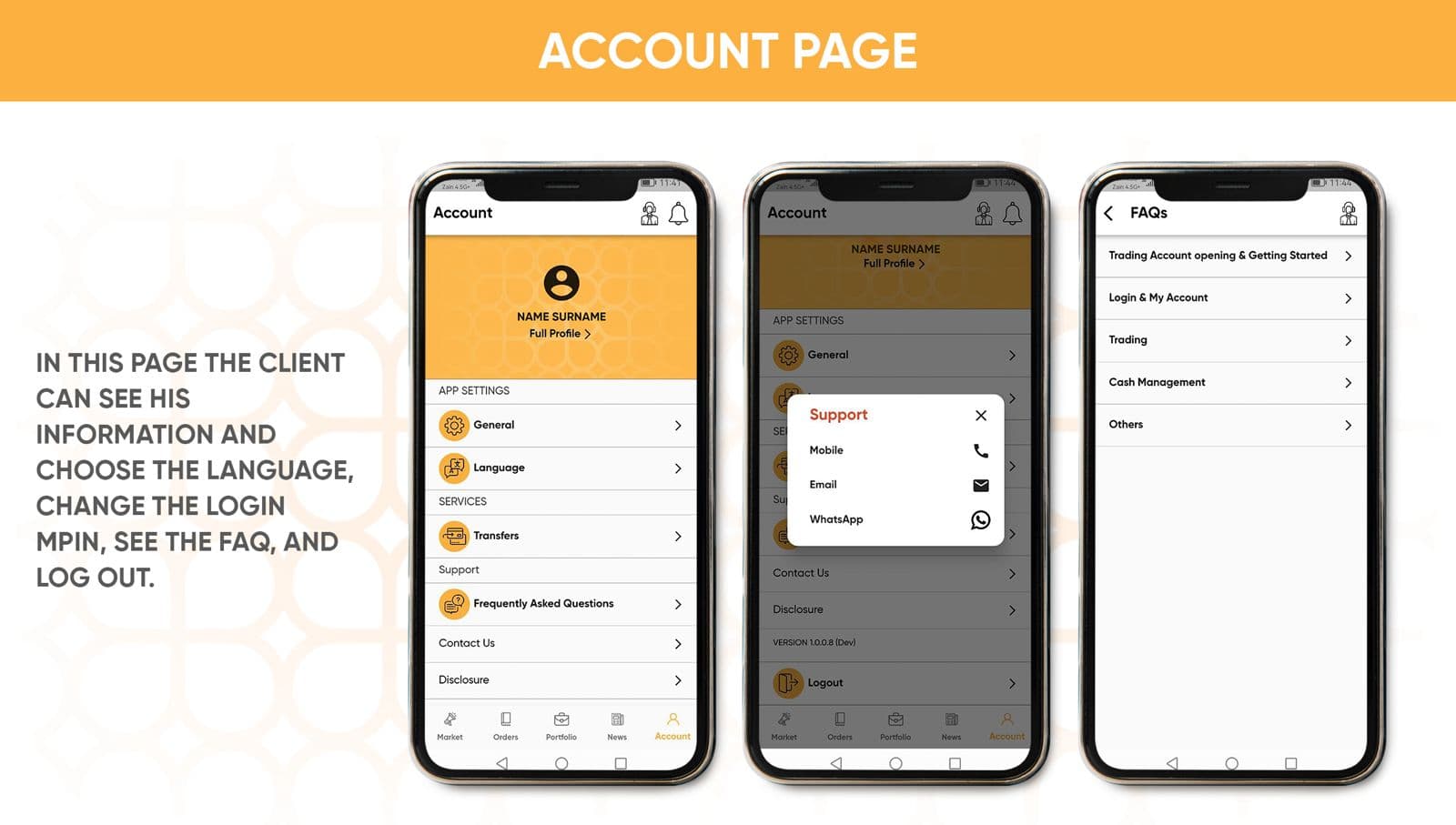

- 7.0.17 13. Account Page

- 7.0.18

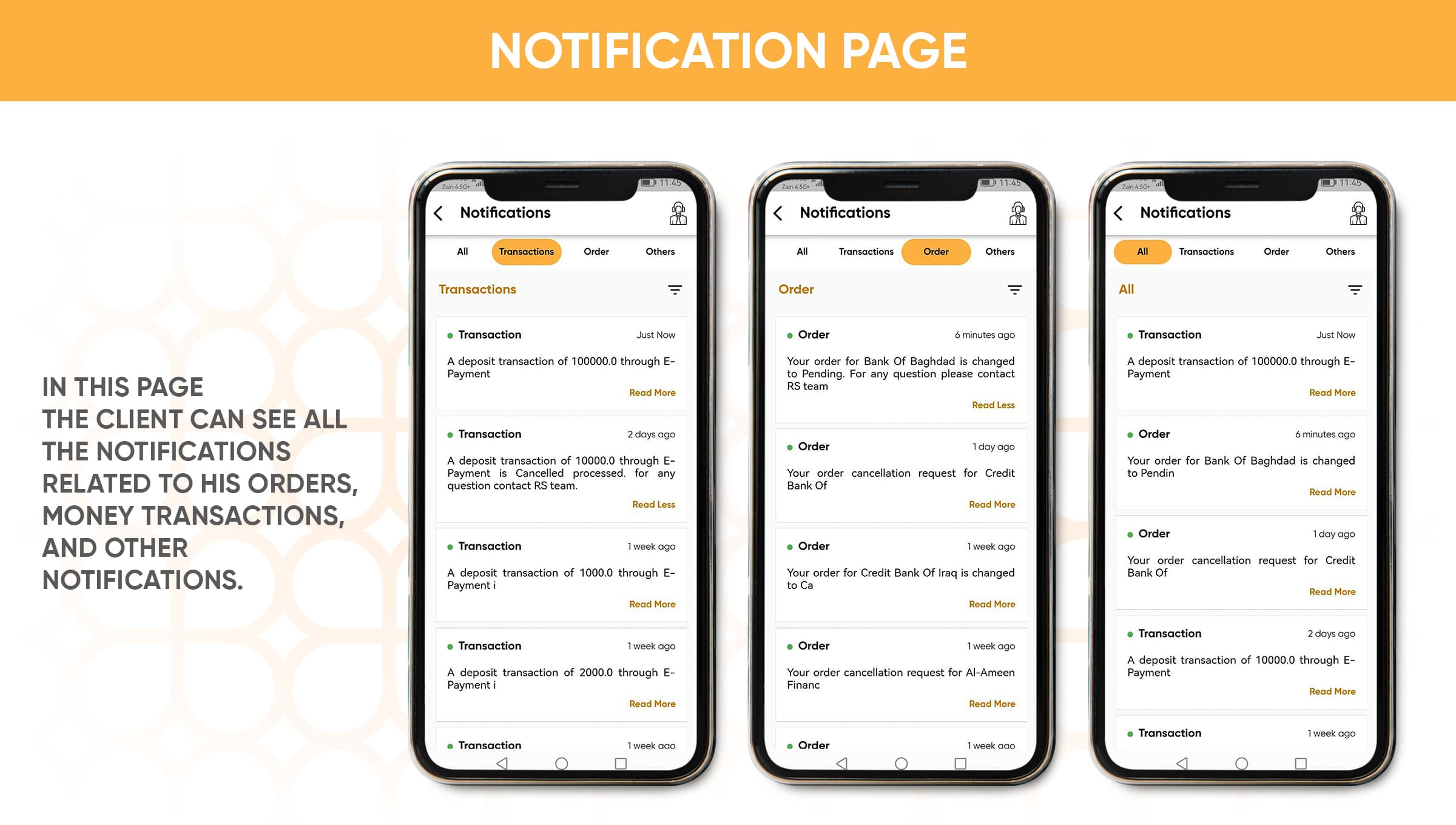

- 7.0.19 14. Notification Page

- 8

- 9 FAQ

- 10 What is a Growth Stock?

- 11 What is a Value Stock?

What should I do first before buying stocks on the ISX?

If you are a beginner in investing in stocks, you need to decide whether you will invest in riskier or more conservative stocks. You might want to avoid taking too much risk if you are new to investing in stocks, and instead, start investing in stocks that grow more conservatively and distribute dividends (a portion of their profits) to shareholders regularly. After gaining experience in trading, you may then consider investing in aggressively growing stocks, taking on more risks to increase the potential for returns.

When deciding to buy a stock, it’s crucial to focus on both its current fundamentals and future expectations. Even if a company’s share price reaches its highest point, if it continuous to grow with investments and is supported by a strong economy and sound fundamentals, the share price can still show an upward trend and achieve new record levels.

Another crucial consideration for beginners when buying stocks is the amount of money they invest. Even with limited funds, consistently investing small amounts in stocks as an investment strategy can lead to compound growth over time. Additionally, reinvesting dividends can significantly contribute to the growth of your investment portfolio, potentially reaching a considerable investment amount in the long term.

How to Buy Stock For Beginners?

If you want to buy stocks, you must open a trading account with a licensed brokerage house in Iraq. The Iraqi Securities Commission (ISC) is the authority responsible for granting licenses to brokerage houses.

(Please click HERE to view information about Rabee Securities on ISC’s website as a licensed brokerage house.)

To open a trading account, you can;

- Visit an office of a brokerage house to fill in the account opening documents, or

- Open a trading account online. It is easy to do so using the RABEE App, available on Google Play and App Store.

Opening a trading account is the most important step in how to start buying stocks, as it enables you to easily transfer money to your account and begin purchasing stocks.

Buying Stocks Via a Direct Stock Purchase Plan

Before starting to buy stocks, you should follow these steps:

- Be clear about your investment goals. Will you focus on growth and long-term wealth accumulation, or income generation and capital preservation?

- Decide how much money you want to invest in stocks with what frequency. While deciding how much to invest in stocks, make sure you reserve enough money for your current and future expenses.

- Know your risk tolerance. Do you prefer stability in your investments, or are you willing to accept higher risks for greater return potential? Stocks can be categorized as value stocks and growth stocks based on the risks involved, primarily the risk of a decline in investment value.

Value stocks: These stocks typically have lower prices relative to fundamental metrics such as profit, book value, or cash flow. They are characterized by strong financials and consistent operations. The risk of a decline in investment value is considered low because these stocks are already undervalued.

Growth Stocks: These stocks offer higher growth potential but carry more risk compared to value stocks. Their share prices grow due to above-average sector growth in revenues, profits, and cash flow. The main expectation of investors is to gain from rapid share price appreciation rather than income from dividends.

Decide whether you will be an active trader, holding stocks for the short-term, or a long-term investor, believing in the continued growth of their share price.

-Being an active trader, who frequently buys and sells stocks, requires time and a thorough understanding of the market.

-Being a long-term investor means not watching daily price movements, but instead, focusing on the investments and expansion of the company that will be reflected positively on the share price in the long term.

In both investing strategies, you should read the company reports and bulletins published by well-known brokerage houses to make informed investment decisions. (For more information about listed companies on the Iraq Stock Exchange, please visit the Reports published by Rabee Securities Research Department. Additionally, you can find an overview of all the ISX-listed stocks, including their price charts, on RS website by clicking HERE).

Buying Stocks with Broker

How to buy stocks for beginners starts with deciding on which broker to open an investment account with, because as an investor, you should expect the best services from your broker. When making this decision, consider the services they offer to their clients and the ease of trading stocks with them.

In developed markets, brokerage houses typically offer research services by issuing reports to their clients. These reports are designed to help clients stay informed about market developments and make well-informed investment decisions. At Rabee Securities, we have been providing high-quality research services to our investors for over 15 years. (For access to our research reports, please click HERE)

When you decide to open an investment account with a brokerage house, you will need to provide them with the required documents either physically or online. After the completion of the account opening process, the final step is to transfer money to your investment account to start buying stocks. (You can transfer money through Zain Cash to RABEE App)

Which Stocks to Buy?

For beginners seeking the best stocks to buy now, it’s advisable to start by looking for less risky investment opportunities in the stock market. When picking stocks to invest on the Iraq Stock Exchange, consider focusing on stocks that reflect most of the characteristics of blue chips.

Blue chips are well-established large companies with:

- Solid financials reflected through healthy balance sheets, consistent revenue growth, high profitability, and sound financial management; and

- A history of stable performance reflected in consistent increases in share price, less volatility compared to other stocks, and typically regularly paid dividends.

It is essential to diversify your investments by allocating funds to multiple companies operating in different sectors which helps to decrease the overall level of risk in your investment portfolio. Additionally, investors should stay updated on the stocks trading on the ISX and continue learning about investing in stocks. With this aim, they can follow the research reports of brokerage houses.

For access to Rabee Securities’ research reports, including the ISX bulletins, dividend history of the companies, comparable profits of the ISX-listed companies, and company reports, please click HERE.

Where to Buy Stocks and How?

For details on how to buy shares through the RABEE App, please refer to the “How can I BUY STOCKS through RABEE App?” section.

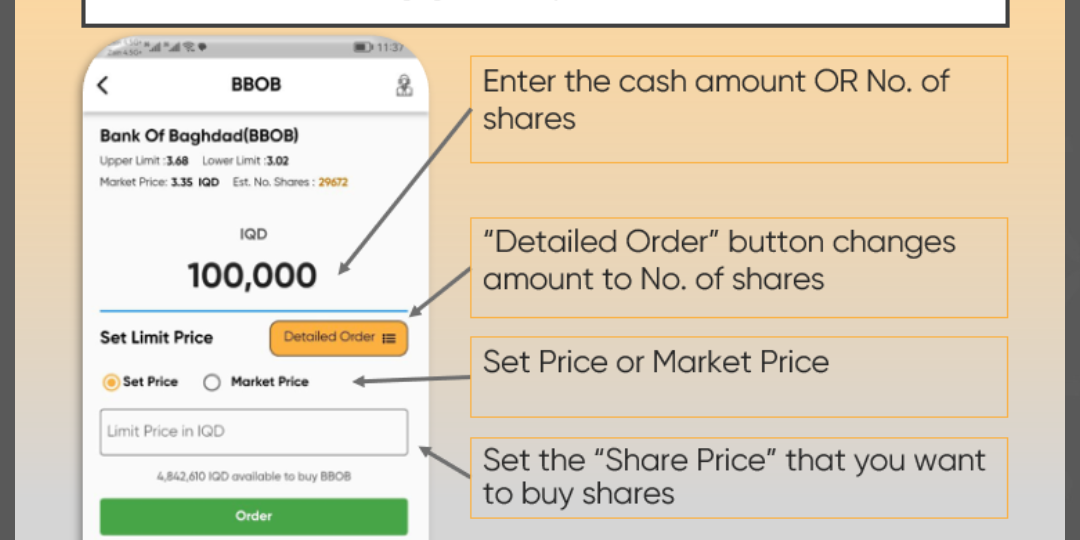

When you decide on which stocks to buy, you need to enter the below information to RABEE App:

- Determine how much to invest (enter either the cash amount or the corresponding number of shares)

- Set the price at which you want to buy the stock (you can either ‘set price’, or choose ‘the market price’ at which the system will buy shares for you at the best available price in the market)

- Click on the ‘Detailed Order’ button to choose the “Order Type” (‘Buy in IQD’ or ‘Buy in Shares’) and the Validity of the order (End of the day, End of the week, End of the month, End of 90 days (which comes by default if you don’t change it), or Custom).

- Click on the ‘Proceed to Order’ button

How Can I Benefit from the Research Reports of Rabee Securities while Picking Stocks to Buy?

Rabee Securities (RS) publishes daily, weekly, and monthly bulletins, benefiting from and organizing the data published by the Iraq Stock Exchange to make it easier for investors to follow the market.

In the ISX bulletins of RS, in addition to the original bulletins of the Iraq Stock Exchange, you can find the following additional information:

- RSISX Index performance (a benchmark price return index calculated since 2007)

- Outstanding political and economic news

- Valuation multiples (P/E, P/B)

- Profitability ratios (ROAE and ROAA) by sectors and for each company

- Average daily trading volume for each company

- The list of top 30 ISX-listed companies by their Market Capitalization (Mcap)

Mcap represents the value attributed by investors to the equity (or ownership) of the company. Therefore, it is used to compare companies in terms of their size.

An Easy Investment Strategy: From RS’ daily bulletins, focus on the 30 largest companies and identify the liquid ones with high average daily trading volumes. Then, evaluate whether the ones with lower P/E and P/B ratios compared to market averages are investable or not. The main aim is to invest in stocks with upside potential in their share price.

From our “Dividend Report (ISX-Listed Companies”, investors can review the dividend distribution history of ISX-listed companies over the last 5 years. If you are interested in investing in stocks that distribute dividends regularly and offer high yields (calculated by RS to provide yield comparison and percentage return calculation), you can follow our Dividends Report, updated quarterly.

For a more comprehensive investment decision making process, consider reading RS Research Department’s Coverage Company Reports. These reports provide in-depth financial analysis and information about company operations.

On our website, you can access price charts of the ISX-listed stocks, featuring adjusted prices that account for dividend distributions and capital increases. These adjustments enable investors to make healthy price performance analyses. Additionally, our website offers key performance ratios and summary financials of the companies, aiding investors in making informed decisions. Our price charts also provide comparable data with the RSISX index, and other companies. Please click for comparable price charts.

For any questions regarding buying stocks, please contact the Rabee Customer Services (cs@rs.iq) or Research Department (research@rs.iq)

Buying Stocks Online: How can I Buy Stocks through the RABEE App?

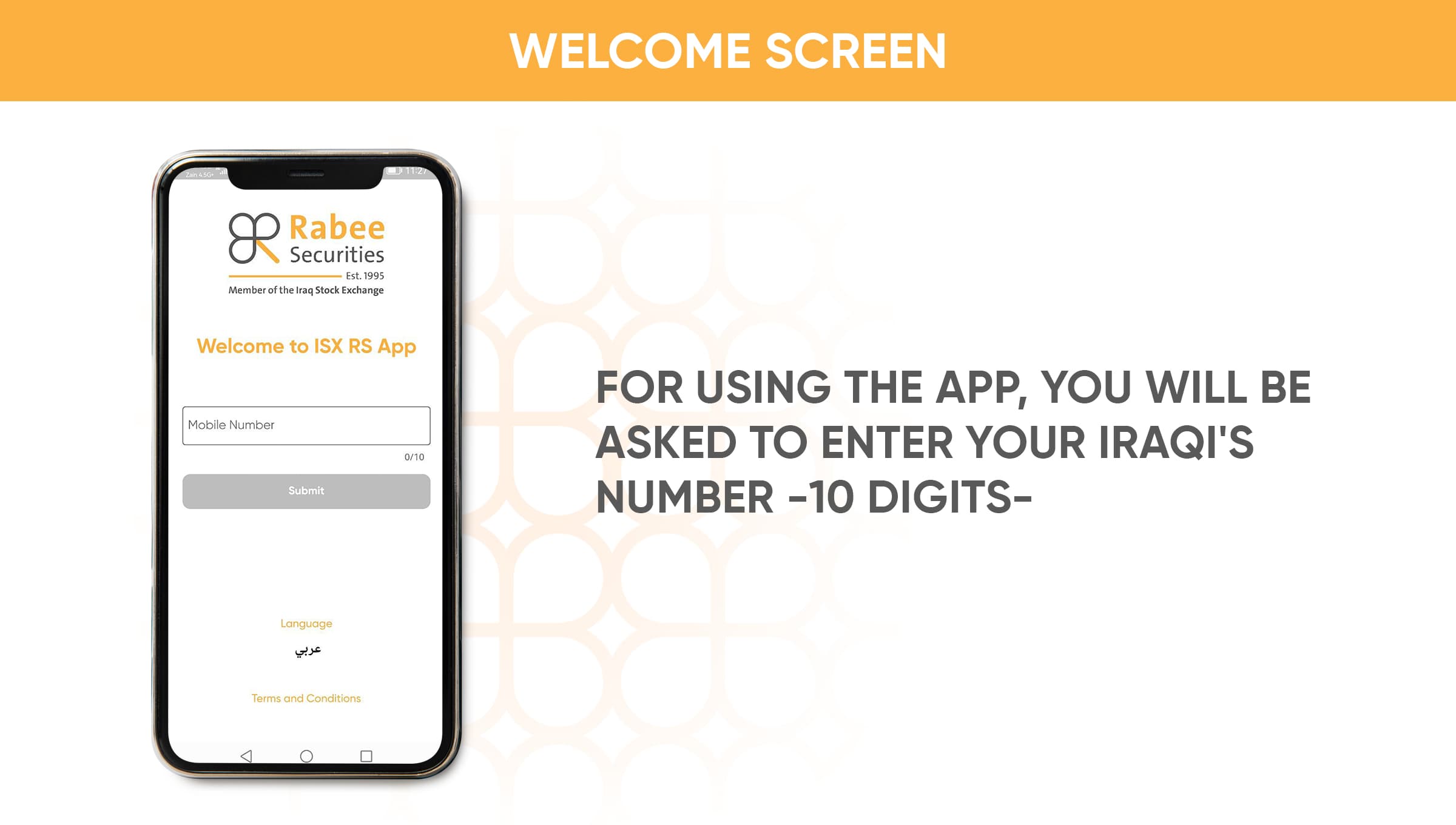

When deciding on the stocks to buy, consider using the RABEE App, a user-friendly app developed by Rabee Securities for online trading on the Iraq Stock Exchange. You can easily open a trading account through RABEE App for free and start buying and selling stocks.

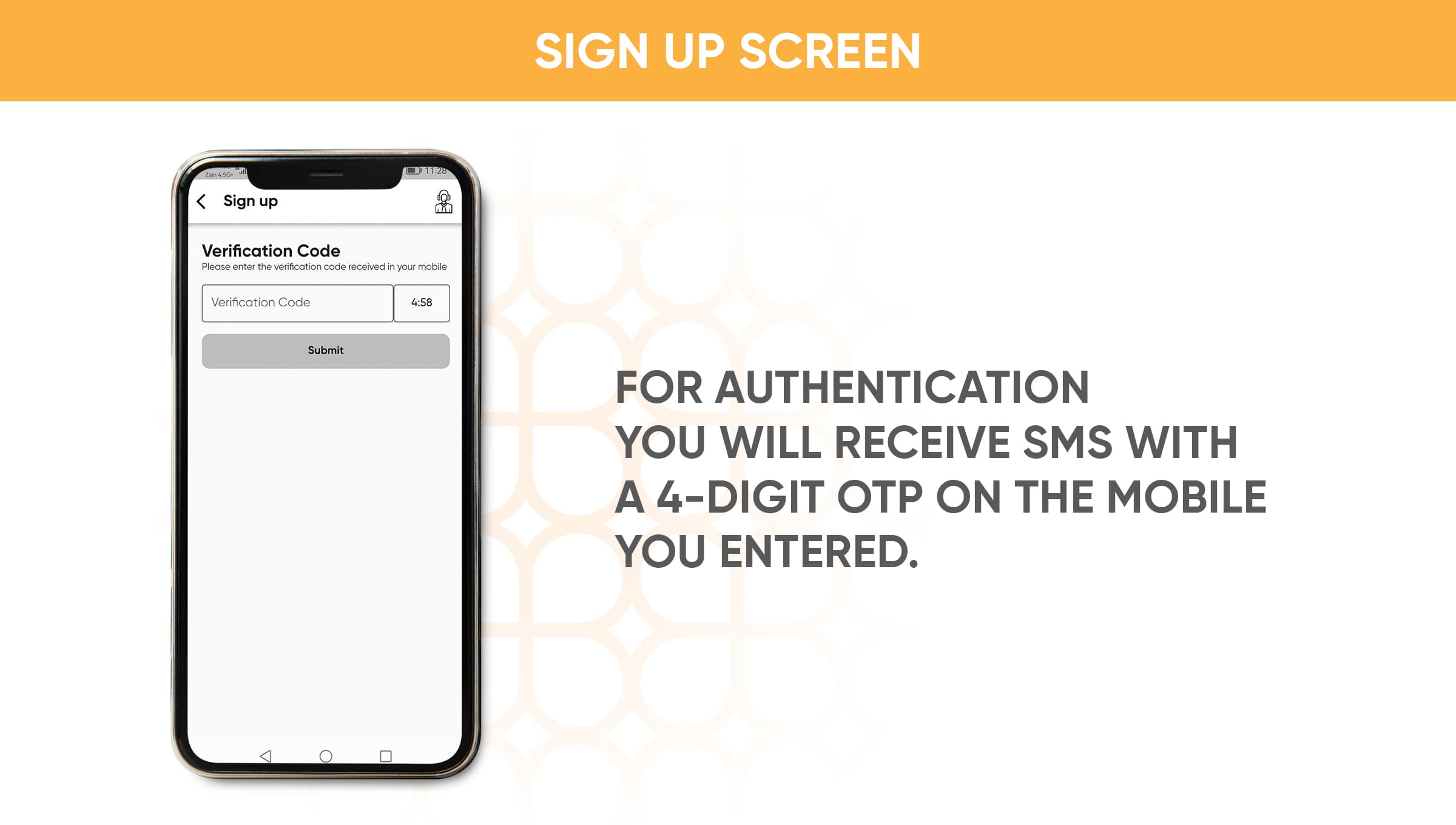

Below are all the major steps explaining how to use our app. If you have any questions, please contact Rabee Customer Service via Whatsapp at +964 783 534 5151 or email at cs@rs.iq)

If you’re unsure how to buy a share of stock, RABEE App will guide you through every step of your purchases. To learn how to buy and sell stocks through the RABEE App, please refer to the visuals below:

1. Welcome Screen

2. Sign Up Screen

3. Login Screen

4. Dashboard Screen |

5. Dashboard Screen ||

6. Stock Details

7. Buy / Sell Screen

8. Detailed Buy/Sell Screen

9. Buy / Sell Screen Confirmation

10. Order Page

11. Portfolio Page

12. News Page

13. Account Page

14. Notification Page

FAQ

What is a Growth Stock?

A growth stock’s share price is expected to grow faster than the market average because these companies are growing faster than companies in the same sector. The growth stocks don’t pay dividends commonly because these companies prefer to reinvest earnings to accelerate company and profit growth. While buying such stocks, investors anticipate capital gains (the gains from the increase in share price) when they sell these shares. A growth stock mostly trades at high price-to-earnings (P/E) ratios due to low earnings but is expected to generate high profits in the future. Because growth stocks do not distribute dividends in general, the only way to make a profit from your stock investment is capital gain, thus investing in growth stocks can be risky.

What is a Value Stock?

A value stock doesn’t reflect its real value due to market inefficiencies, in other saying it trades at a lower price compared to the generated earnings, and sales, and distributed dividends. In general, these stocks distribute dividends with high yield (high dividend yields), and trade at a low P/B and P/E ratios. These stocks often issue dividends because they require less capital for growth due to reaching a good level of size in operations. Some investors only invest in value stocks by purchasing the highest dividend-yielding stocks. (To see the highest dividend yielding stocks on the Iraq Stock Exchange (ISX) please go to Rabee Securities’ Research Department’s Dividend Reports “ISX-Listed Companies”.