Table of Contents

- 1 What Are The Advantages of Investing in the Iraq Stock Exchange?

- 2 What are the Advantages of investing in stocks compared to other investment vehicles?

- 3 What Are The Disadvantages of Investing in the Iraq Stock Exchange?

- 4 What are the Disadvantages of investing in stocks compared to other investment vehicles?

- 5 What are The Misconceptions About Being a Shareholder?

What Are The Advantages of Investing in the Iraq Stock Exchange?

Investing in the stock market in Iraq comes with opportunities and risks. Here are some general pros and cons associated with investing in the Iraq Stock Exchange (ISX):

-Potential for High Returns

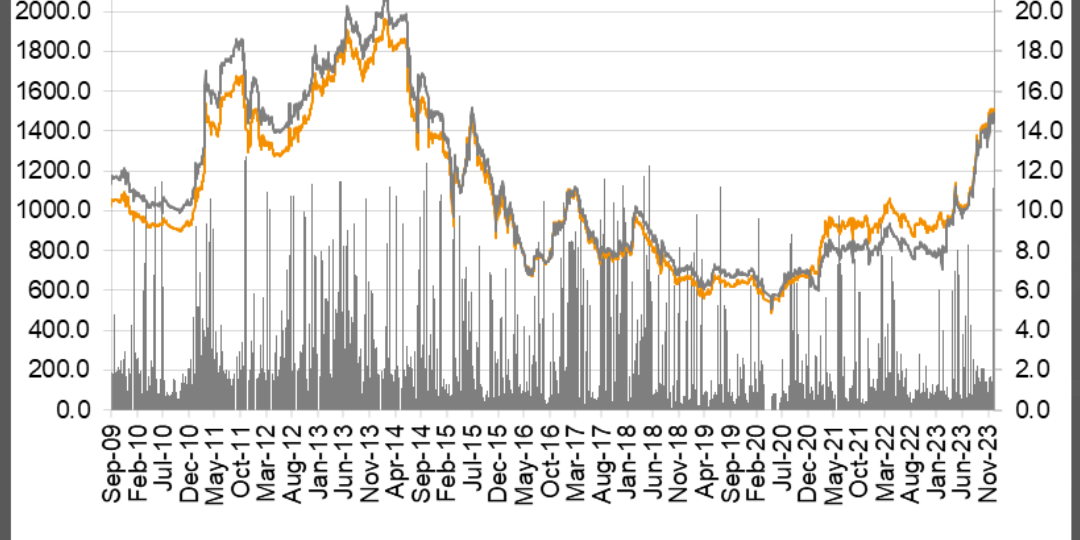

Iraq, as a frontier market, has a potential for high returns, especially with its growing oil-rich economy and young population. In addition, the security situation has been getting better in recent years, which supports the growth of the economy. Moreover, the Central Bank of Iraq (CBI) is supporting the growth of the economy by taking important measures to stabilize the local currency against the US Dollar which is also benefiting from the accumulating net foreign reserves. RSISX Index (a benchmark index calculated by Rabee Securities to reflect the performance of the ISX) showed robust growth in 2023 and recorded a 50% increase in local currency terms and a 73% increase in US Dollar terms in the first 10 months of 2023. (Please click HERE to see the RSISX Index chart)

-Undervalued Stocks

Due to historical challenges, geopolitical factors, and very limited knowledge about the stock market (TV Channels are not talking about the Iraq stock market, and only RS sponsored a TV program about the ISX for 2 years to increase the interest and the general knowledge in the local market. Please click HERE to go to RS’s YouTube channel to watch the episodes), the interest in the ISX is lower than it should be thus most of the ISX-listed companies are undervalued which can simply be observed by looking at Price-to-Book ratios which were lower than 1.0 for 46 out of 103 ISX-listed companies as of Nov. 15, 2023. That means around half of the ISX-listed companies’ market value is less than their equity value (paid-in capital plus accumulated reserves). According to the general belief, if a company’s Mcap is lower than the value of its Equity (which means its P/B is less than 1.0), then the price per share increases at least to reach Book Value Per Share (BVPS) (=Equity/Outstanding Number of Shares).

-Enables Diversification

Investing in the Iraq Stock Exchange (ISX) can provide diversification for investors; because while investing in real estate and gold for capital gains, and depositing money to banks for interest income, they can also invest in the ISX to gain from the increase in value of the companies and their dividend distributions). Moreover, investing in Iraq also provides geographical diversification for investors who invest in different countries by reducing the risk exposure to a single market.

What are the Advantages of investing in stocks compared to other investment vehicles?

-Stock market investment grows in line with the growth in the economy

As the economy grows, so do corporate earnings, thus investors in the stock markets gain both through dividend distributions and increases in share price as a reflection of the growing businesses.

-Easy to Invest

It is easy to buy shares of companies through the stock exchanges. All you need is to open a trading account at a licensed brokerage house. When your account is opened, you will send money to your account and you can buy stocks immediately after that.

-You can invest with a very small amount of money

Buying only one share will be enough to be a shareholder at that company. (Please go to “What are the misconceptions about being a shareholder?” to better understand what will bring you to buy stocks and what will not.”)

-High Liquidity

The stock market allows you to sell your stock at any time and turn your shares into cash quickly with low transaction costs, which means high liquidity.

What Are The Disadvantages of Investing in the Iraq Stock Exchange?

-Geopolitical Risk

Iraq has faced political instability and security challenges which can impact the stock market. On the other hand, we have seen an upward trend in stock prices even if there was no government in the past. Iraq is a country that is used to political and security challenges and the country is growing despite these factors.

-Economic Challenges

Iraq is an oil-dependent country. Around 90% of government revenues and 60% of GDP are obtained from oil exports. The dependency on oil creates pressure on the economy and the stock market during the decline in global oil prices.

-Low Liquidity

The ISX has low liquidity compared to more established markets which makes it difficult to buy or sell shares at desired prices from time to time, thus, investors mainly prefer to invest in stocks that are more liquid than others.

-Currency Risk

Currency risk is important when investing in markets with less stable currencies. Despite the gap between Iraq’s official FX rate and the parallel market FX rate, CBI has required banks to depend only on the official FX rate while buying and selling US dollars starting February 2023 to stabilize the local currency.

-Limited Information and Transparency

In Iraq, most of the ISX-listed companies do not have investor relations departments and they are not familiar with providing information to investors. Information disclosure and financial transparency are limited compared to more mature markets which makes it harder for investors to make well-informed decisions. (As Rabee Securities, we provide research reports including coverage company reports to provide detailed financial analysis and information about the ongoing operations of the ISX-listed companies to make it easier for investors to make investment decisions.)

-Infrastructure Challenges

Iraq faces infrastructure challenges that are impacting the operations and profitability of companies listed on the stock exchange mainly including physical transfer of money and products.

-Regulatory and Legal Risks

Regulatory frameworks and legal systems haven’t been as developed as in more mature markets; however, the draft security law will (when it comes to force) help support the development and growth of the Iraq Stock Exchange.

While investing in stock exchanges in frontier markets, like Iraq, it is important to consider the following:

—Thoroughly research the companies trading on the ISX, and the overall economic and political situation in Iraq before making investment decisions.

—You can use the ISX not only for investment but also as a means to diversify your portfolio. By investing a portion of your accumulated funds, you can effectively manage risk.

—Seeking advice from financial professionals while investing on the ISX will help you to navigate the unique challenges of investing in stocks. (Please contact with RS Team for your questions regarding investing in the ISX)

–Investing in frontier markets like Iraq can offer potential rewards, but it requires a careful and informed approach. Please stay updated on the geopolitical situation, economic developments, and regulatory changes to make well-informed investment decisions. (Please go to Rabee Securities Website to Research Reports to follow the daily, weekly, and monthly bulletins that provide all this information for investors. You can also send email to research@rs.iq if you want to receive these reports through email).

What are the Disadvantages of investing in stocks compared to other investment vehicles?

You may risk your initial investment

If a company you invested in through the stock exchanges operates poorly, investors will be willing to sell its shares more than willing to keep or buy them which will result in a decline in its share price, thus, you will lose some part of your initial investment while planning to increase it.

Stockholders paid last during a bankruptcy

Even if bankruptcies rarely happen, creditors get paid first while shareholders get paid after.

You need to spend time while making investment decisions and after investing in stocks

If you are investing in stocks on your own, you must read research reports and bulletins to determine which companies are operating well and if they are profitable investment options. You should learn the basic terms to understand the financial statements and the analysis made by the equity research analysts. You should also follow the general market trends to make sure that you are investing during upward trends while trying to be conservative in investing during downward trends.

When you buy a share, you need to understand what buying a share will bring you, and it is for your benefit to understand the misconceptions about being a stockholder. In general, buying a share will not grant you direct control over the company’s operations; and you are not entitled to discounts on the company’s products.

1-You are not the Boss

You can’t directly interfere with how the company is managed. If you’re not satisfied with the management, you can sell your shares at any time. You can also vote for the board of directors (if your shares have voting rights), as they typically hire both upper and lower management as well as subordinate employees. If you are content with how the company is managed, all you need to do is hope for a good return.

2-You can’t Get a Discount on Goods and Services

Some people might expect to receive discounts on products or services when they own shares in a company, but this is generally not the case, except for some exceptional instances in international markets. For instance, you can’t request a discount on a Pepsi product simply because you own shares in Baghdad Soft Drinks (IBSD). Additionally, providing discounts to shareholders could lead to a significant decline in revenues if the company has a large number of shareholders. This, in turn, may adversely affect profitability and share prices. Therefore, offering discounts to shareholders may not be a desirable situation for the shareholders themselves.

What you should expect from buying a stock is to gain from the increase in share price and receive distributions from the profits.