Table of Contents1 What Is the RSISX Index and Why...

Table of Contents1 Financial Statement Analysis2...

Table of Contents1 Introduction to Technical...

Table of Contents1 What Causes Market Volatility?2...

Table of Contents1 What is Portfolio...

Section Title

Table of Contents1 What Is the RSISX Index and Why Does It Matter?2 How Is the RSISX Index Calculated?3 What Does the RSISX Index Tell Me?4 Is the RSISX a Price Return or Total Return Index?5 How Are...

Table of Contents1 Financial Statement Analysis2 P/E Ratios and Valuation3 Revenue Growth Assessment4 Debt-to-Equity Analysis5 Frequently Asked Questions6 References Fundamental analysis provides...

Table of Contents1 Introduction to Technical Analysis2 Reading Stock Charts3 Support and Resistance Levels4 Moving Averages Explained5 Trend Analysis and Identification6 Frequently Asked Questions6.1...

Table of Contents1 What Causes Market Volatility?2 Key Economic Indicators to Watch3 Oil Prices Impact on ISX4 Political Stability and Stock Prices5 Frequently Asked Questions The Iraq Stock Exchange...

Table of Contents1 What is Portfolio Diversification?2 Sector-Based Diversification in Iraq3 Risk Management Through Asset Allocation4 Building a Balanced ISX Portfolio5 Frequently Asked Questions5.1...

Table of Contents1 How to Buy Stocks?2 Where to Buy Stocks?3 Buying Stocks with Broker4 How do you calculate how many shares you can buy with your investment amount? 5 Steps to Calculate How Many...

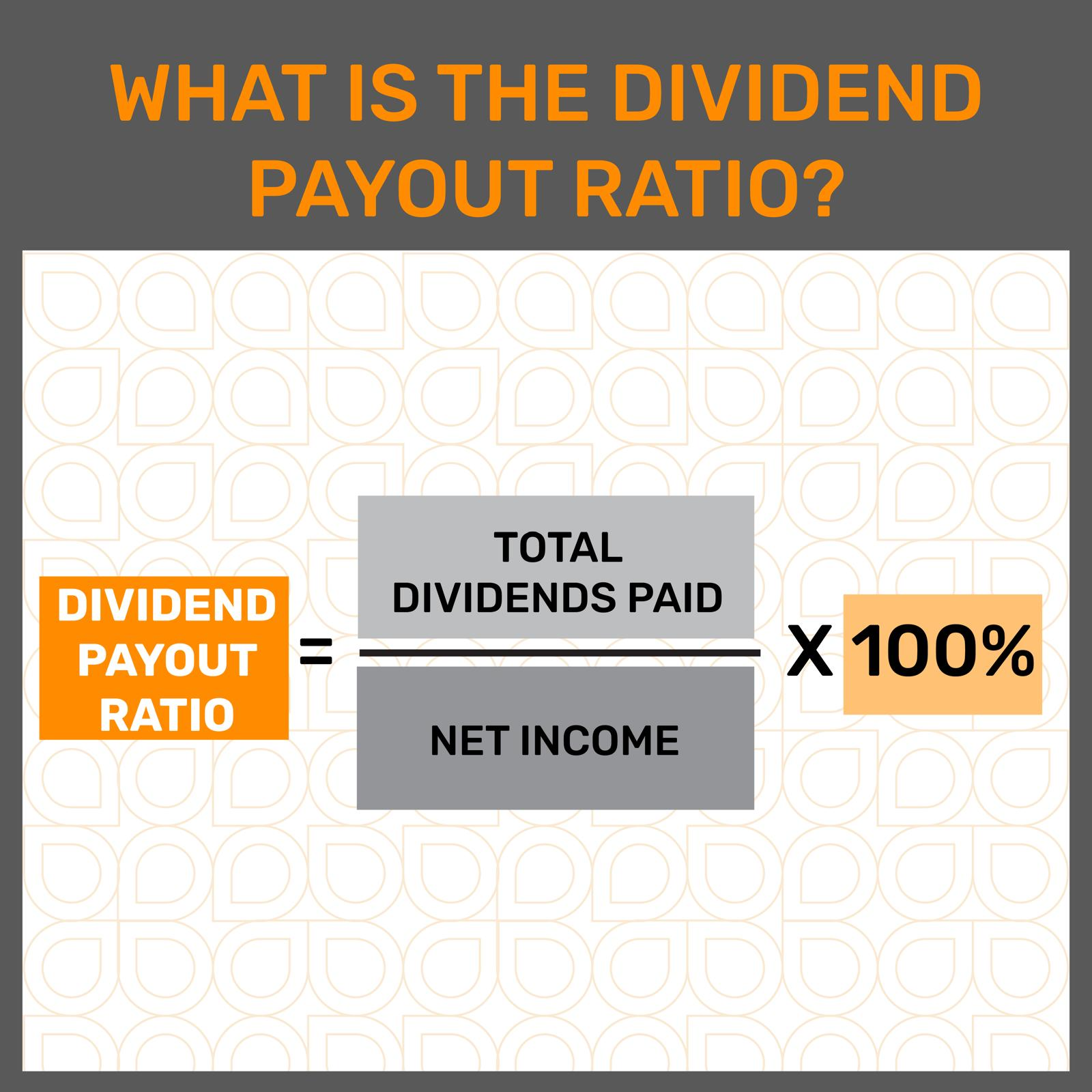

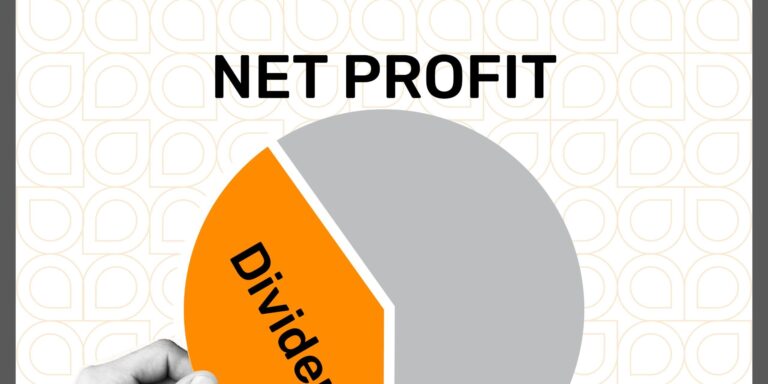

Table of Contents1 What is a dividend?2 What does dividend mean?3 What are dividend stocks?4 Why are dividends important for investors?5 What are the different types of dividends?6 How are dividends...

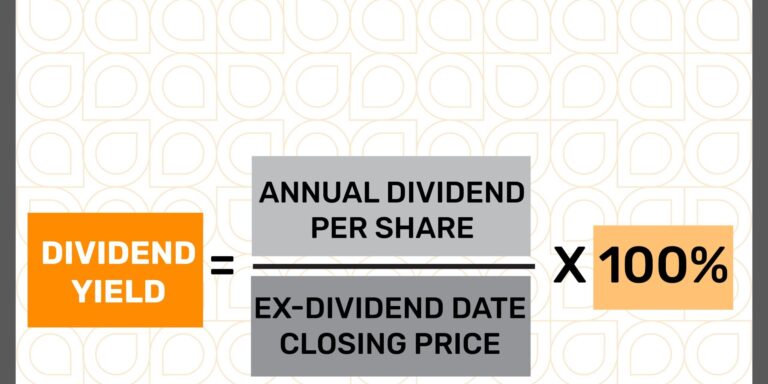

Table of Contents1 What is the dividend yield ?2 How is dividend yield calculated?3 Why is dividend yield important? 4 Examples of Dividend Yield5 What does dividend yield tell me, and how can I...

Table of Contents1 What is Dividend Reinvestment?2 What is a dividend reinvestment plan (DRIP) and how does it work?3 What are the advantages of reinvesting dividends?4 What are the benefits and risks...